Enterprise Value vs. Purchase Price: What is the “True” Purchase Price in M&A Deals?

In this tutorial, you’ll learn about the Enterprise Value vs. Purchase Price in M&A deals and why the Purchase Enterprise Value represents the “true price” in most cases.

Enterprise Value vs. Purchase Price: What is the “True” Purchase Price in M&A Deals?

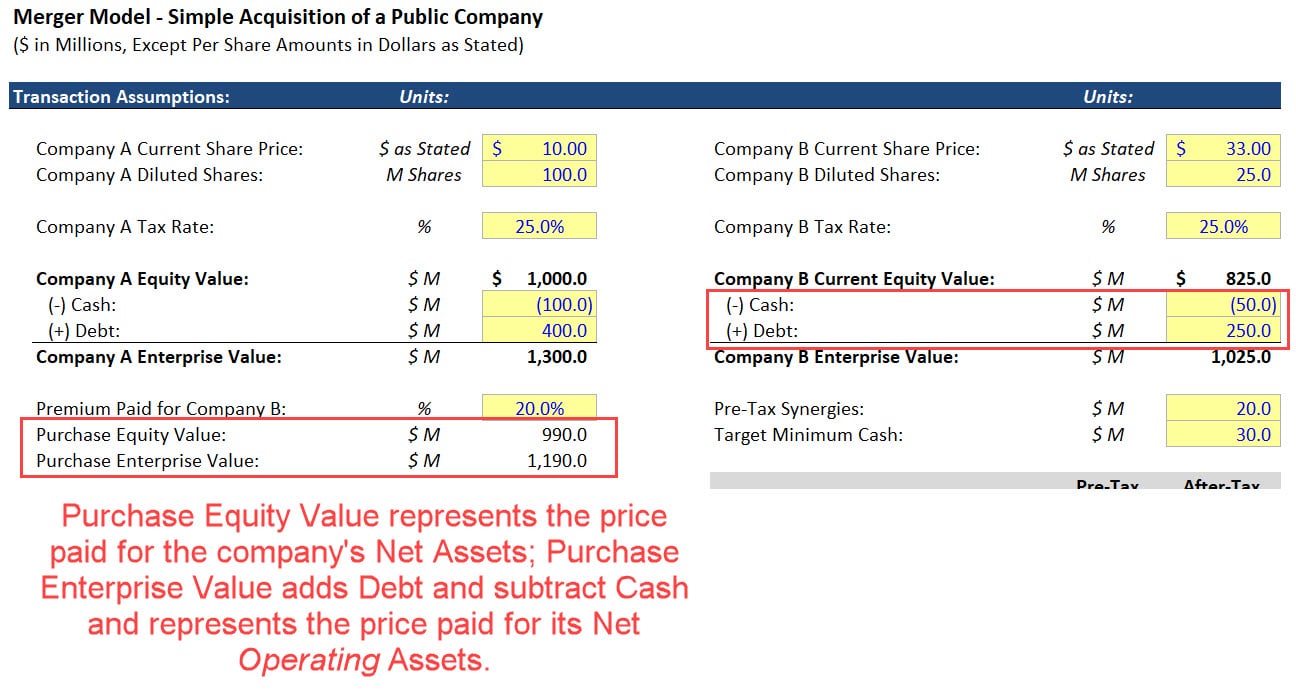

Enterprise Value vs. Purchase Price Definition: In mergers and acquisitions, the Purchase Enterprise Value represents the “true price” because it corresponds to the value of the acquired company’s net operating assets; metrics such as Purchase Equity Value and “Transaction Value” may also be useful in analyses, but they are not the “true price” in the same way.

We receive many questions about the difference between Purchase Equity Value, Purchase Enterprise Value, and Transaction Value: How they differ, what they mean, and which ones are useful when analyzing M&A deals.

First, we should define two very important terms:

Purchase Equity Value: This equals the Offer Price per Share for the acquired company * its (diluted) common shares outstanding. If a buyer pays $10.00 per share for a seller with 150 shares, the Purchase Equity Value is $1,500.

Purchase Enterprise Value: This equals the Purchase Equity Value + Seller’s Debt – Seller’s Cash, and other items may be included as well, depending on the Seller’s Balance Sheet. For more, see our tutorial on how to calculate Enterprise Value.

If the same seller above has $200 of Debt and $100 of Cash, the Purchase Enterprise Value is $1,500 + $200 – $100 = $1,600.

The conceptual difference is that the Purchase Equity Value represents the price paid for the seller’s Net Assets (Assets – Liabilities), while the Purchase Enterprise Value represents the price paid for just its Net Operating Assets.

-

Become a financial modeling pro

158 videos, detailed written guides, Excel files, quizzes, and more

-

Complete 10+ detailed global case studies

These include both the theory and the practical applications

-

Prepare for your internship or full-time job

Gain the skills you need to “hit the ground running” on Day 1

The short version of the Enterprise Value vs. Purchase Price distinction is as follows:

1) True Purchase Price – The Purchase Enterprise Value is closest to the “true price” in an M&A deal.

2) Seller Proceeds – The seller’s shareholders, however, do not receive this Purchase Enterprise Value; they receive the Purchase Equity Value because they are only paid for their common shares.

3) M&A Modeling – In merger models and EPS accretion / dilution calculations, the Purchase Equity Value is often more relevant because the seller’s existing Cash and Debt usually make a marginal impact on the combined statements – even though they factor into the “true price.”

This last point tends to be why this topic causes so much confusion: The “true price” is not necessarily the most relevant metric for financial modeling purposes, especially in acquisitions of public companies.

Here is the Excel file and slide presentation for this tutorial:

Simple Merger Model – The “True” Purchase Price (XL)

Enterprise Value vs. Purchase Price – Slides (PDF)

Video Table of Contents:

0:00: Introduction

3:56: Why Purchase Enterprise Value is the “True Purchase Price”

7:01: Adjustments to Purchase Enterprise Value

8:40: The Seller’s Proceeds

9:24: The Price in M&A Models

12:16: Recap and Summary

Enterprise Value vs. Purchase Price and Why the Purchase Enterprise Value is the “True Price”

As a baseline in any deal, the buyer must pay for all the seller’s shares, corresponding to the Purchase Equity Value, or Offer Price * (Diluted) Common Shares.

If the seller has Debt, the buyer has three options:

1) Assume the Debt, i.e., keep it in place as-is (rare because most debt agreements do not allow this).

2) Refinance the Debt, i.e., issue new Debt for the same amount and use the proceeds to repay the existing Debt (the most common outcome, by far).

3) Repay the Debt with Cash on hand (very rare).

If the buyer repays the Debt in full (option #3), it’s obvious that the Debt increases the effective price because the buyer is paying extra.

But even with the first two options, the buyer effectively pays for the Debt because it either assumes responsibility for it or issues new Debt and now has responsibility for repaying that new Debt.

Saying that refinancing the seller’s Debt doesn’t represent “payment” is like arguing that when you refinance a mortgage on a home, the new mortgage doesn’t count toward the total price.

Of course it does! Yes, maybe it’s a new issuance, but a home’s total price is still based on the equity + debt (mortgage) used to buy it.

With the seller’s Cash, there are two main options:

1) In cash-free debt-free deals, it might be distributed to the seller’s shareholders as the deal closes.

2) In acquisitions of public companies, it might be retained by the buyer and added to its total Cash balance.

But in either case, the seller’s Cash reduces the effective acquisition price.

In the first case, the Cash distribution will reduce the Purchase Equity Value, and the buyer will pay less for each of the seller’s shares.

This is because Equity Value is based on Net Assets, and a Cash distribution to shareholders reduces the company’s Net Assets.

In the second case, the buyer “gets” the seller’s Cash when the deal closes, which reduces its effective price.

Yes, maybe it paid $1,000 for the seller’s shares, but it also got the seller’s $200 in Cash, so it only “paid” a net amount of $800 for the seller.

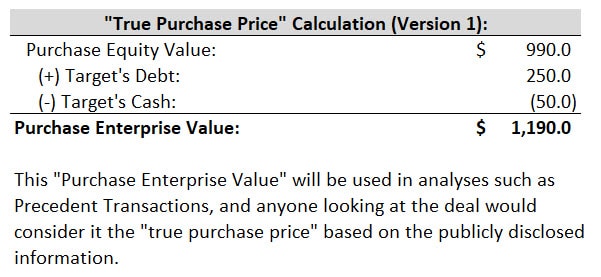

Therefore, since the seller’s existing Debt always increases the effective price, and the seller’s existing Cash always reduces it, the “true price” is the Purchase Enterprise Value: Purchase Equity Value + Debt – Cash.

We might calculate it as shown below in the simpler merger model example used in this article:

Enterprise Value vs. Purchase Price: Other Adjustments

Some people argue that the Purchase Enterprise Value is close to, but not exactly, the true price in M&A deals because of other adjustments.

For example, each M&A deal involves transaction fees for legal, accounting, and advisory services, and if the buyer uses Debt or refinances existing Debt, there will also be financing fees.

Also, in cash-free debt-free deals, the seller has a Minimum Cash requirement, and since it distributes all its Cash to shareholders, the buyer must pay for this.

So, you could argue that we should subtract (Total Cash – Minimum Cash), or the seller’s Excess Cash, rather than the Total Cash when calculating the “true price.”

This alternative calculation is shown below:

The Seller Proceeds in an M&A Deal

The point about the seller proceeds in deals is very straightforward: If it’s a public seller, the shareholders get the Offer Price * (Diluted) Common Shares, AKA the Purchase Equity Value.

For private sellers in cash-free debt-free deals, the buyer pays the Purchase Enterprise Value, and the seller repays its Debt using all its available Cash.

If Debt remains, it’s deducted from their remaining proceeds; if Cash remains, it adds to them.

Therefore, the seller proceeds equal this same Purchase Equity Value: Purchase Enterprise Value – Debt + Cash.

Since we’re moving from Enterprise Value to Equity Value, we “cross the bridge” in the opposite direction.

Enterprise Value vs. Purchase Price in M&A Modeling and EPS Accretion / Dilution

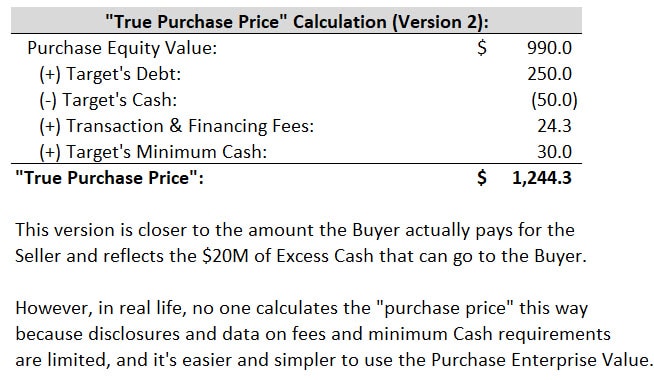

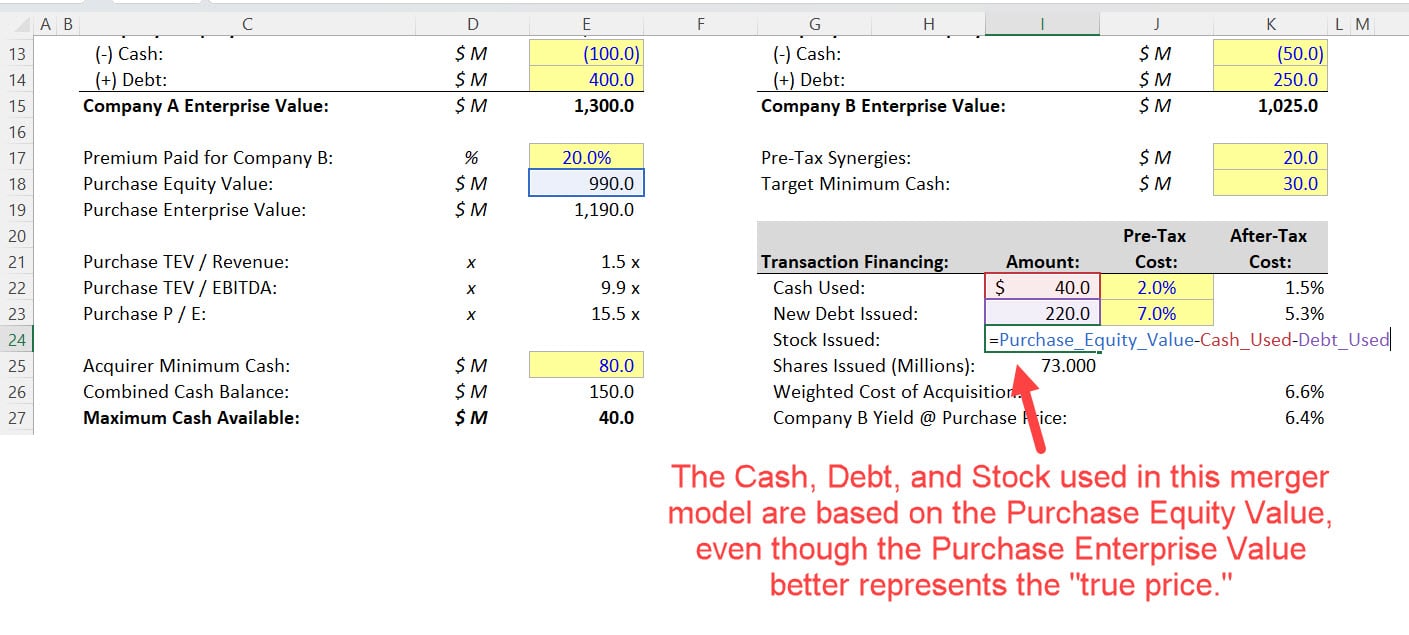

In the context of a merger model, the Purchase Equity Value is often the more relevant driver because a seller’s existing Cash and Debt make a marginal impact in most cases.

For example, if you’re calculating the amount of Cash, Stock, and Debt that a buyer must use to fund a deal, you’ll typically base them on the Purchase Equity Value:

This happens for two main reasons:

1) Combined Interest Income – If the buyer “gets” the seller’s Cash, the Combined Interest Income is simply the buyer’s Interest Income + the seller’s Interest Income. The purchase price and offer premium make absolutely no difference.

2) Combined Interest Expense – If the buyer assumes or refinances the seller’s Debt, the Combined Interest Expense equals the buyer’s Interest Expense + the seller’s Interest Expense. Again, the deal price makes no difference because these items are combined. There may be a minor adjustment if the interest rate on the Debt changes.

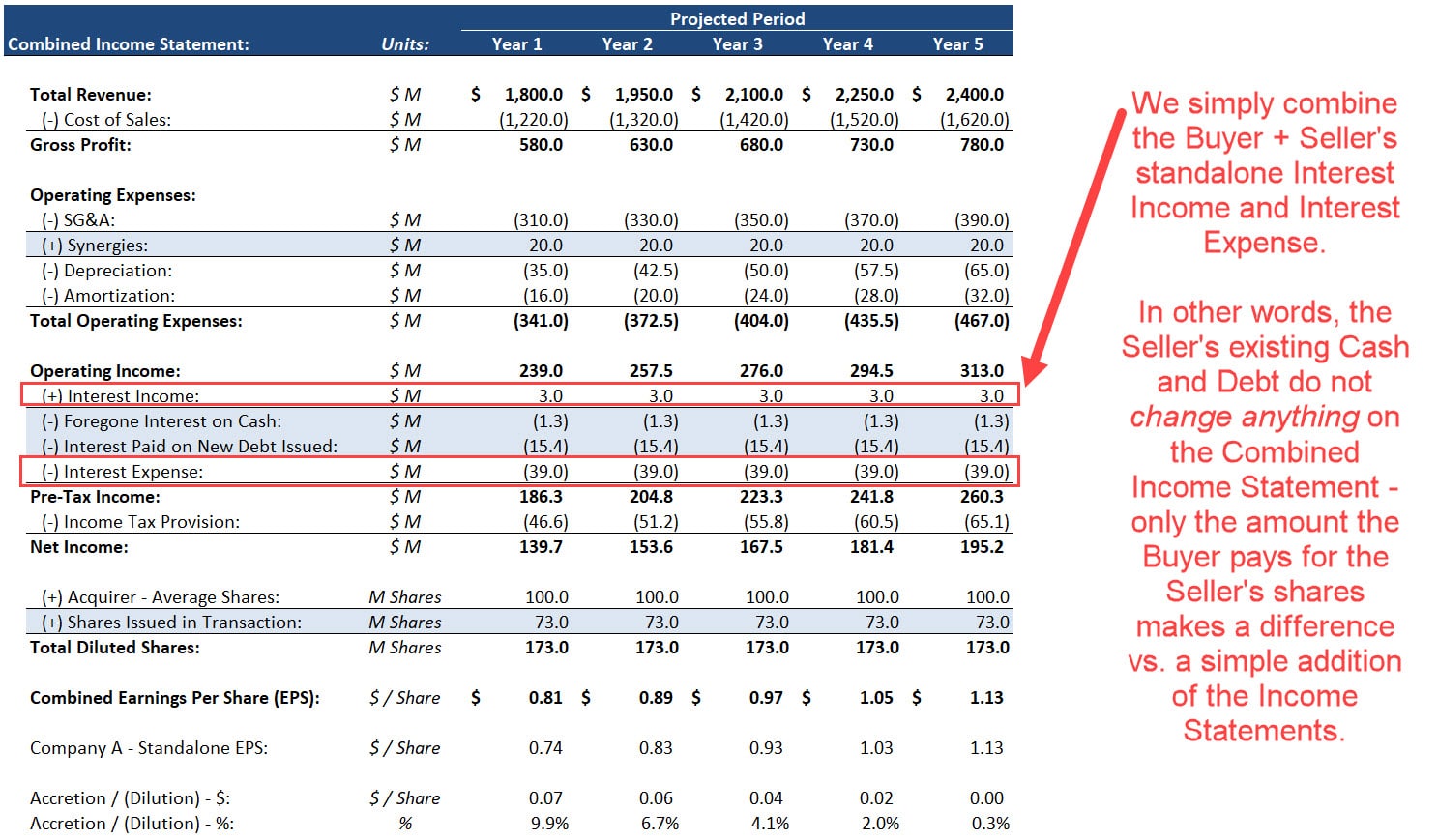

This image of the Combined Income Statement sums up the rationale:

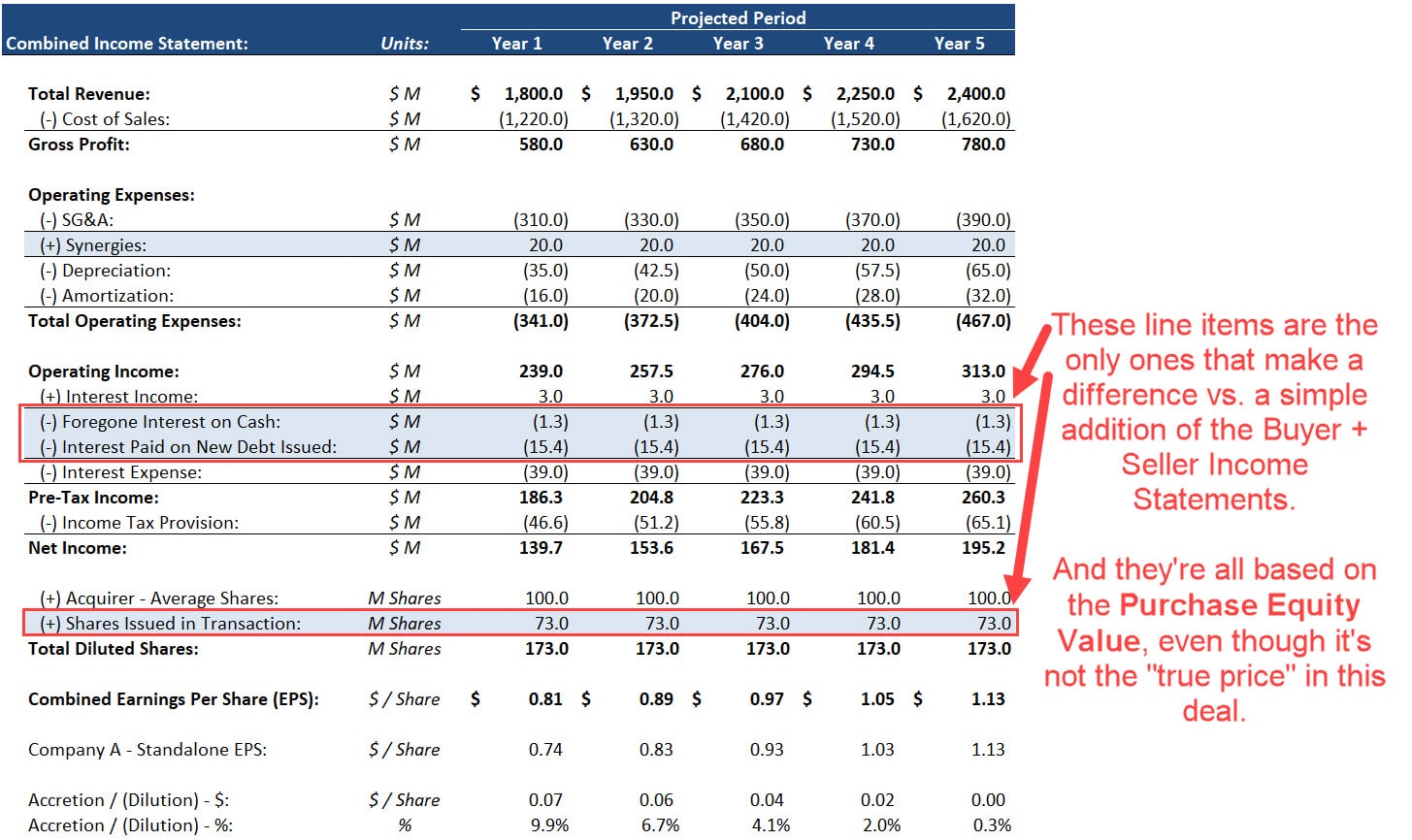

In other words, only the Purchase Equity Value results in changes on the Combined Income Statement over a simple combination of the buyer + seller’s Income Statements.

The three main ones are the Foregone Interest on Cash, Interest Paid on New Debt, and New Shares Issued:

In a cash-free debt-free deal, the seller’s Debt works the same way: The buyer refinances it, and the Combined Interest Expense equals the buyer + seller’s separate Interest Expense lines.

The Interest Income and Cash are slightly different in this case because the seller’s Cash will decrease, so its Interest Income will decrease – however, the Purchase Equity Value will also be lower because of this Cash distribution.

Therefore, even in a cash-free debt-free deal, the Purchase Equity Value is more of a model driver, although you will have to adjust the Combined Interest Income slightly.

“Transaction Value” and Other Metrics

Finally, you might wonder about metrics such as “Transaction Value” or “Transaction Size.”

The short answer is that people use these metrics when they don’t know if they’re referring to the Purchase Equity Value, Purchase Enterprise Value, or something else, such as the % Acquired * Purchase Equity Value.

You need to clarify what they are referring to because “Transaction Value” is a vague term that could refer to anything here.

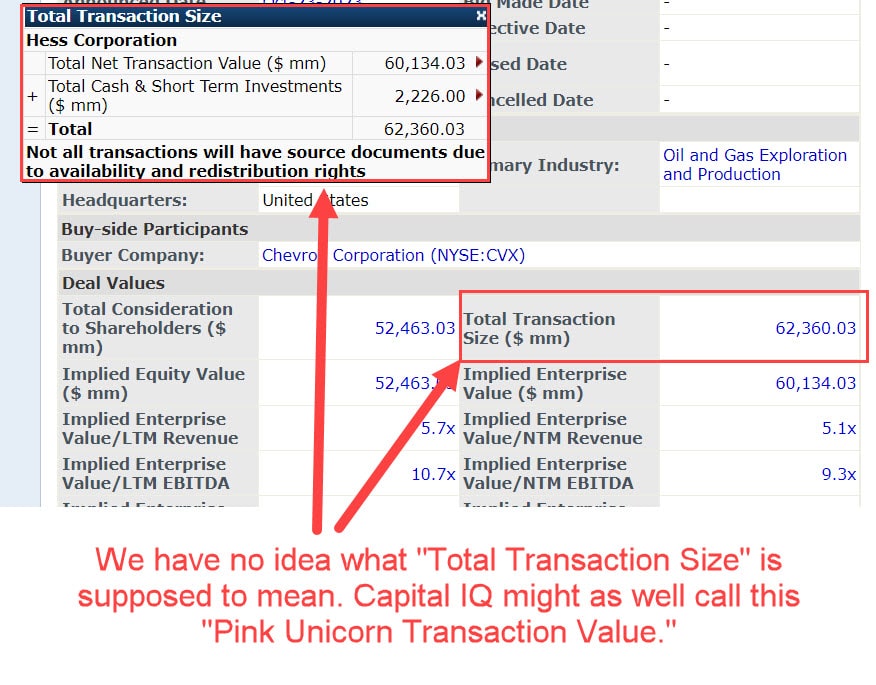

Sources like Capital IQ make this even more confusing by defining a “Transaction Size” metric in its Precedent Transactions template that equals the Purchase Enterprise Value + Cash; we have no idea what this is supposed to represent:

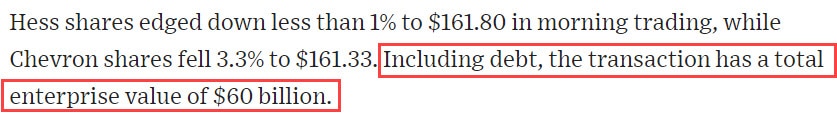

When you see language such as “including debt” or “including assumption of net debt” in press releases, this refers to the Purchase Enterprise Value:

But if you’re in doubt, or something doesn’t quite add up, your best option is to review the deal filings and acquired company’s financials to resolve this Enterprise Value vs. Purchase Price question.

About Brian DeChesare

Brian DeChesare is the Founder of Mergers & Inquisitions and Breaking Into Wall Street. In his spare time, he enjoys lifting weights, running, traveling, obsessively watching TV shows, and defeating Sauron.