"Now You Can Master Excel, Financial Modeling, and PowerPoint to Break Into Investment Banking and Fast-Track Your Way to Promotions and Top Bonuses"

Master Excel, financial modeling, and PowerPoint

302 videos (with subtitles), detailed guides, Excel/PPT files, and more

Complete 10+ detailed global case studies

No other training provides the same conceptual and practical expertise

Prepare for interviews and the job

Detailed study plans give you different pathways to course completion

Gain an Advantage by Mastering the Three Topics that Matter the Most in IB Interviews and On the Job:

You can read endlessly about how to prepare for investment banking interviews, internships, and full-time jobs, but it’s always a mix of “soft skills” (communication ability, writing emails, etc.) and “hard skills.”

The BIWS Premium package gives you a leg up over everyone else with detailed training for the three most important “hard skills” in investment banking and private equity:

1 Your ability to answer technical questions and build financial models.

Technical knowledge is required to win finance internships and full-time jobs today. You need to understand the concepts at a deep level so that you’re prepared for any question that comes up – especially at firms such as “elite boutiques” that love to ask outside-the-box questions.

And you also need the accounting, valuation, and financial modeling skills on the job since you’ll be spending a good chunk of your time valuing clients, potential clients, and potential investments.

The Financial Modeling lessons in this package walk you through 10+ case studies, ranging from simple, 30-minute exercises up to 3-hour models, and they explain everything step-by-step with video tutorials, notes, written guides, and more.

2 Your skills with Excel, including the key shortcuts, formulas, and formatting tricks.

All financial modeling work is done in Excel, so you need to be quick with the key shortcuts, formulas, and formatting – or you’ll be stuck at the office at 4 AM wondering how to fix the color coding in your model or set it up for printing.

Our Excel training walks you through everything from the basic navigation shortcuts up to VBA and macros to automate your workflow – and you’ll get our custom Quick Access Toolbar (QAT) and macro package to make you even more efficient.

Along the way, you’ll get plenty of practice exercises to ensure that everything “sticks.”

3 Your PowerPoint skills, including quick alignment, formatting, the slide master, and more.

In most investment banking roles, you spend a lot of time drafting presentations for clients and potential clients… which makes PowerPoint just as important as Excel.

But people tend to assume it’s “easy” to use – which couldn’t be further from the truth. Using the program efficiently for business purposes is completely different from inserting cat animations or drawing pictures.

You’ll boost your productivity by 10x if you master the key shortcuts to align and format slides and you have plenty of example presentations and pitch books to work from – so you get both of these in spades in this training.

Oh, and you’ll also get our full macro package, which automates 25+ common tasks in IB presentations, and you’ll even put it into practice with a dozen exercises where you use thee macros to fix slides.

Our BIWS Premium package is designed around these three critical topics.

Yes, there’s a ton of other stuff in the package, including investment recommendation templates, sample pitch books, practice quizzes, and the end-of-course certification quizzes…

But if you master the core Excel, PowerPoint, and financial modeling skills, the rest is icing on the cake.

What You Get – And What the BIWS Premium Course Will Do for You…

When you’re interviewing for internships and full-time positions at investment banks, you’ll always get a few questions over and over…

- How good are your Excel skills?

- How much do you know about accounting?

- Can you walk me through a valuation or DCF?

- What happens in a merger model or LBO model when you adjust the assumptions…

- How would you describe your financial modeling skills?

- Can you show us a sample presentation you’ve created? How are your PowerPoint skills?

Master practical financial modeling skills based on well-known global companies and deals, not abstract theory.

When you master real-world techniques and you have ADVANCED knowledge, you automatically improve your chances of landing prime jobs and internships with the top investment banks, private equity firms, and hedge funds.

To succeed in the super-competitive world of investment banking, the hardest part is often “getting your foot in the door”.

BIWS Premium lets you gain advanced-level knowledge via video-based training and case studies based on client advisory presentations, stock pitches, investment recommendations, and more.

BIWS Premium combines our three most popular training courses into one complete package, all at a deep discount:

Excel & VBA

Core Financial Modeling

PowerPoint Pro

BIWS

Premium

These are the skills you need to get the top jobs and beat out other candidates… and the skills you’ll need to advance up the ladder, move to lateral roles, and move to buy-side opportunities such as private equity and hedge funds.

You’ll Start by Mastering the Key Excel Shortcuts, Formulas, and Formatting, and Then You’ll Learn How to Automate Your Workflow with VBA

- Intro, Setup, and Navigation Lessons teach you how to optimize your system and Excel setup, navigate, use the ribbon menu and the format dialog box, and use the key shortcuts for cells, rows, and columns, including absolute and relative references and naming and jumping to cells.

- Formatting and Printing Lessons cover the key shortcuts for formatting, built-in number formats, date/time/text manipulation, and how to clean up data, set up custom number formats, format financial models, and use conditional formatting.

- Financial Formula and Lookup Function Lessons teach you logical, arithmetic, and financial functions, as well as lookup functions, INDEX, MATCH, and INDIRECT. You’ll also learn about array functions, OFFSET, sensitivity tables, Goal Seek and Solver, circular references, and XLOOKUP and dynamic array functions in Office 365.

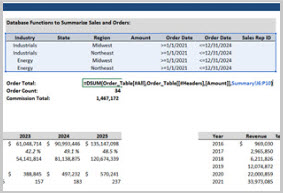

- Data Manipulation and Analysis Lessons teach you how to use data tables, sorting and filtering, Power Query for importing data from the internet, SUMIFS, SUMPRODUCT, and database functions. You’ll also learn how to use pivot tables and Power Pivot to slice, dice, and aggregate data according to different criteria, and you’ll practice customizing the tables, creating visualizations, and using Calculated Columns and Measures to build KPIs.

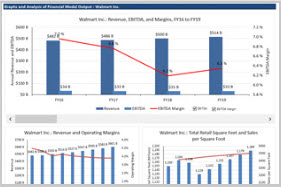

- Chart and Graph Lessons cover graph setup in Excel, ranging from the basic line and column charts up through dynamic charts with checkboxes and scroll bars. You’ll learn how to create charts that are specific to investment banking and finance roles, such as valuation multiple graphs, football field valuation charts, price-volume graphs, and waterfall bridge charts for analysis of companies’ financial results.

- VBA, Macro, and User-Defined Function Lessons cover programming concepts such as loops, range and cell manipulation, variables and constants, arrays and dictionaries, and string manipulation. You’ll create macros for “Input Box” cell creation and the color-coding and printing of financial models, and then you’ll expand on those by writing macros to cycle number formatting, change the decimal places for numbers with different formats, flip the signs, and flash fill right and down. You’ll also write macros to toggle the error-wrapping of formulas, toggle absolute vs. relative vs. mixed references, go to the min and max of a range, create Tables of Contents, and create Price-Volume Graphs.

Next, You’ll Master Accounting, Valuation/DCF Analysis, and M&A and LBO Modeling with Financial Modeling Case Studies Based on Companies and Deals Across the Globe

And Then You’ll Finish Your Training by Becoming a PowerPoint Pro, Including Shortcuts, Macros, and Templates to Triple Your Efficiency…

- Setup, Shapes, and Slides Lessons explain how to set up the Quick Access Toolbar (QAT) for improved shortcuts and how to align, distribute, and format shapes and text, including the use of tools such as the ruler and drawing guides. This module is your “crash course overview” for the most useful bits of PowerPoint.

- Text and Tables Lessons show you how to use line spacing, tab stops, and bullet points on slides and how to use tables to enhance text, shapes, and images and create unique layouts and process diagrams.

- Slide Master Lessons teach you how to use the Slide Master to create “Layouts” (templates) for different types of slides and how to use it to set up headers, footers, slide numbers, formatting guides, and company logos. You’ll also learn about Sections and the Slide Sorter view.

- Excel, Image, and Word Integration Lessons explain how to insert Excel models, charts/graphs, images, Word data, and custom objects such as maps into PowerPoint; you’ll also learn how to create charts natively in PowerPoint and how to set up the infamous “football field” valuation graph using tables and Excel data.

- Shortcut and Macro Practice Exercises give you practice creating the remaining slides in the Jazz Pharmaceuticals presentation using a combination of built-in PowerPoint commands/shortcuts and the macro package in this course. You’ll also learn about more advanced features and slide types, such as SmartArt and “Timeline” slides.

- The Bank Pitch Book Database and Editable Slide Templates give you a collection of 175+ real bank presentations hosted on the sec.gov website across different industries and deal types. You’ll learn how to find useful slides in these presentations, and you’ll get a set of 50+ editable slide templates based on the best examples.

- Outside Tools, Add-Ins, VBA, And Macros (Full VBA Course) – This is a full crash course on VBA in PowerPoint, where you’ll build many of the macros included in the course macro package. You’ll start with the basics, such as a macro to swap two shapes’ positions, and you’ll build up to more complex ones involving drawing guides, tables, and objects such as Harvey Balls and Calendars.

- PLUS: You’ll get immediate access to our full macro package for PowerPoint, which automates 25+ tasks common in investment banking presentations, such as resizing and distributing images to fit a table. You’ll also get our customized Quick Access Toolbar (QAT) and the full pitch book and slide template databases.

Gain Official Recognition of Your Training

With BIWS Certifications

After completing the course materials, you’ll be eligible to take our challenging Certification Quiz.

Once you earn a score of at least 90%, you’ll receive a personalized Certificate of Achievement with your name, the course name, and the date you passed the quiz:

Add your Certificate of Achievement to your resume/CV and/or present it in interviews to set yourself apart from other candidates.

We also make sure employers know that this is a serious qualification: Your certificate will contain a link where prospective employers can review what’s on our exams and what you must master to receive the certification.

Unlike other training companies that “issue certifications,” our process is completely transparent: you can literally point to the exact questions you had to answer to pass the quiz and become certified.

Once interviewers see you really do have the “chops” to be a banker, your chances of hiring success go way, WAY up.

Hear What Our Customers Have to Say About Their Results with BIWS Premium

“Great news, I just got a full-time offer in IB J.P. Morgan in London!! Your courses have been absolutely key in achieving this.”

“I used your course to build up my financial skills and then wrote my own research and financial model on Ryanair. I sent this off to a VC, who hired me soon after. I was then transferred to a hedge fund, where I find myself working now - applying the skills you have taught me.”

“I purchased the Financial Modeling and Bank Modeling coursework, and was blown away at the depth of the material. In particular, the accounting material helped me the most. Especially since it was all brought into the context of M&A, as opposed to an Accounting 101 class.”

“I moved from being a tax accountant/lawyer with a Big4 accounting firm to now working in the investments team of a PE fund. This would not have been possible without the core grounding I got from your practical courses in financial modeling.”

“I worked in this role for a little over a year and I was recently offered a position at a PE firm in NYC. I had modeling tests and case studies that I passed with ease because [of] everything that I had done in my down time with BIWS, especially the merger/LBO tutorials.”

“I managed to get a Leveraged Finance internship offer at BNP Paribas thanks to your Excel & Fundamentals course.”

“Three months later, I'm an extremely happy chappy!”

“Your method of training and how focused you are on the necessary techniques to be productive in the office is what makes these courses genuine and unique, and is precisely what I need.”

“I just landed a job in a private equity fund, and I could not have done it without this course.”

“BIWS is a great resource that definitely helped me improve my understanding of many topics.”

“Also wanted to let you know that I ended up landing a role as a Senior Consultant in FIG Corporate Finance, which you helped me with earlier last year. Your advice, and the Excel & Fundamentals & Bank Modelling courses were phenomenal.”

“I have learned more about the technicalities of the industry through these lessons than 1. being a finance major at a reputable college, and 2. having an internship with a boutique investment bank.”

“I ended up getting 2 IBD and 1 consulting internship offer[s]. It is hard to put to words how this has helped me but I have no doubt that my life is a lot easier because I bought the courses.”

“I just wanted you to know that I think your BIWS Excel course is probably one of the most valuable ways [that I] could have spent my time before starting an analyst position at a REIT 5 months ago.”

“I have purchased the whole course available on your website and I believe it has been one of the best investments I have made.”

“You are simply the best in the industry. In fact, through the improved efficiency I have gained and noticed by senior management, our company decided to make your course an onboard course for all new analysts.”

“The way I see it, the modules of the Financial Modeling Fundamentals course are an exceptional complement to any university-level corporate finance class.”

“I cannot [imagine] surviving that first round without having gone through this experience... Safe to say that my increase in salary after having broken in does quite a bit more than cover the cost of these two guides that I purchased.”

“The best thing about BIWS [that sets it] apart from [other] courses is you can ask them the most basic question and they will get back to you within a couple of hours. It could be any question - career advice / questions related to modeling / advice on [the] resume or cover letter and advice on your story.”

“It has been extremely helpful as I have seen improvements after each interview where there is some sort of financial modeling and accounting assessment.”

“I am almost halfway into the completion of the course and I already believe that this is one of the best [decisions] I have made till now for my education.”

“Clear and concise explanation of concepts that are sometimes hard to comprehend.”

“I'm a CFA charterholder and in my personal opinion, BIWS has taught me 10x more useful skills for investment banking than the CFA curriculum did.”

“It's one of the best study materials I have used - not just within investment banking, but among all other materials I have ever used (and I have used a lot for different subjects throughout the years).”

“I was an accounting major and I have done accounting for a used car dealership for 5 years now, and I learned things in this course which I never knew before.”

“Your product is, by far, the best in the market. I tried a couple of competitors' products as well when preparing for both IB and PE interviews (FOMO of those having the silver bullet I could not find in BIWS I guess...) and there simply is no comparison to the depth, quality, and usefulness of it.”

“Without your course, there was no way I could have pursued an "organic" strategy, where I was able to secure a full-time IB role with no internships and now finally get into healthcare PE. So thank you, this has completely transformed my life.”

Our Interactive Learning Portal Is Your Roadmap to Fast Understanding and Quick Answers from Our Expert Support Team

And here's a sample video from the Excel & VBA lessons so you can see exactly what you get:

Here's a sample video from the Core Financial Modeling course, so you can get a sense of the valuation and modeling training:

And finally, here's a sample video from the PowerPoint Pro course, so you can see how you'll master the key PowerPoint shortcuts, alignment tricks, and other tips:

Plus Expert Support From Experienced Investment Bankers

Just moments after you enroll, you’ll receive Instant Access to the entire course.

But that’s not the best part.

The best part is expert support, for a full 5 years after purchase!

If there’s anything at all you don’t understand, just go to the “Question/Comment” area below each and every lesson, and ask your question there.

These comments are monitored and responded to by our expert support team – every one of whom has personal experience working on deals at investment banks, private equity firms, and other finance firms.

That ensures that you’ll get responses from people with deep experience in the field – not a clueless high school temp clutching the “Help Desk” manual.

This personalized, expert support is one of the things that sets Breaking Into Wall Street apart and gets you to your goals more quickly.

You can often learn just as much from reading other questions and our responses as you will from the lessons themselves!

Our 1-on-1 coaching rate is $200+ per hour. But when you invest in BIWS Premium, personal support is included for FREE.

NOTE: There are some limitations to these support services. For example, we cannot complete models, case studies, or homework assignments for you.

We also cannot provide play-by-play support with an earpiece during interviews.

We’re happy to answer career-related, qualitative, and technical questions that are related to the course materials.

What’s Your Investment in BIWS Premium?

To put this in context, let’s look at your Return on Investment in this Program…

The pay for entry-level investment banking jobs varies from year to year, but it’s safe to say that even entry-level Analysts earn between $150,000 and $200,000 USD right out of university.

At the MBA level, that climbs to $300,000 to $400,000 USD. And as you progress, your total compensation only gets higher and higher; top bankers earn 7 figures annually. And every top banker had to start at the entry level and get their foot in the door, just like you today.

Compared with the potential upside, your investment in this Program is nominal.

Your investment in the full BIWS Premium program (including ALL of the valuable content and training detailed above) is just $497.

So, in other words, by investing just $497 in this course, you’re greatly improving your chances of landing a job that pays at least ~$150,000 in Year 1 – that’s just over a 300x return on investment!

Even if this training only helps you to land an internship, you’re still looking at around $15,000 for that internship at a large bank – an ROI of 30x.

There is simply no other way it is possible to get this level of training… this level of support, help, and troubleshooting on demand… this level of testing and certification… and this level of access to a community of thousands of peers…

…at ANY price!

So yes, you have to invest in yourself to gain access to BIWS Premium, but that investment will be one of the smartest, highest-return investments you ever make – we guarantee it!

We’ve bent over backwards to deliver the best, most comprehensive program on the market that gives you everything you need to make absolutely sure you get the results you want and land a great job and a long-term career in investment banking, private equity, or hedge funds.

To date, over 56,763 people have invested in BIWS training and gone on to secure lucrative and stimulating jobs in the industry. I want you to be next, and I want to make this a “no-brainer” decision for you.

Here’s What Will Happen Within Minutes Of You Signing Up

The next move is up to you.

You can hope that an investment bank hires you without Excel, PowerPoint, and financial modeling skills… good luck to you there…

Or you can confidently tell banks you’ve invested in the most advanced Excel, PowerPoint, and financial modeling training based on 10+ global case studies, authored by experienced investment bankers who have worked on dozens of deals.

I know you’ll make the right choice.

To YOUR success,

Brian DeChesare

Breaking Into Wall Street Founder

P.S. If you are seeking to gain an edge in your interviews, during your summer internship, or even during your first few years in IB, PE, or hedge funds, this course will give you that edge.

It will give you everything you need to master the technical, hard-skill aspects of the job without spending 2-3 years as an Analyst or Associate first. Nothing beats years of deal experience, but this course is the next best thing.

Enroll now, and you’ll have access to everything in just a few short minutes.

Installment Plans Available (Pay in 4, 6, or 12 Monthly Installments)

Get Instant Access to BIWS Premium

ADD TO CART

100% Unconditional Money-Back Guarantee